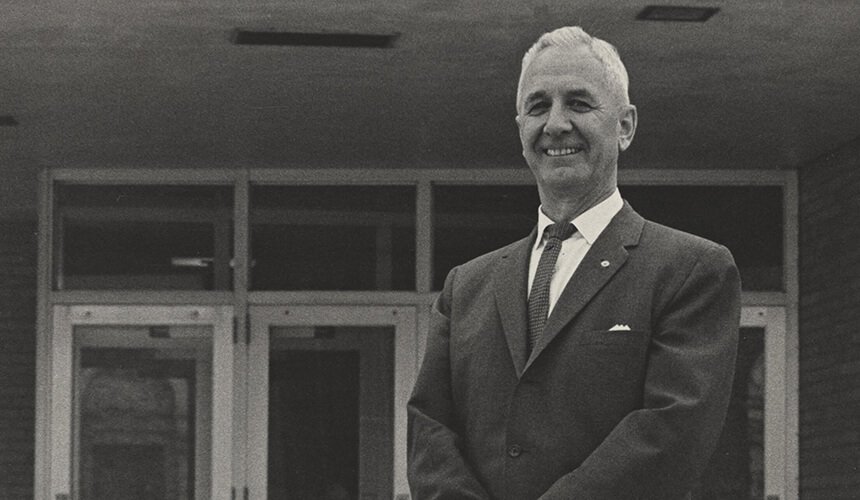

Stephen Hawk and Frank Graner

Bullish on Investment

Frank Graner PhD1948’s dream of allowing UW–Madison business students to work the levers of Wall Street — with all of the markets’ real-time rewards and consequences — came to life under his former student Stephen Hawk BBA1963, MBA1964, PhD1969.

The Stephen L. Hawk Center for Applied Security Analysis (ASAP) started with a $100,000 initial gift from the Brittingham Trust in 1970. The center’s students have grown those funds, and their work has attracted more substantial responsibilities, including, as of 2005, $40 million from the UW System Trust Fund. Today, ASAP manages more than $50 million in assets.

It was the diminutive, chain-smoking Graner — a popular and conversational lecturer who joined the faculty in 1948 and taught at the business school for 21 years — who envisioned building a program in which students learned by trading and clear-headed analysis.

Image courtesy of the UW Archives.

Albert “Ab” Nicolas BS1952, MBA1955, who built the investment firm of Nicolas and Company, recalled how Graner’s passion ignited his own. “At a time when stocks were hardly recognized as prudent investments, when the Dow Jones Industrial average was 200 to 300 and the average daily trading volume was 2 million shares, he made it all very real, very exciting,” he said.

In the 1950s, Graner often discussed the idea with friend Tom Brittingham Jr., heir to a lumber fortune. He tried to get the Board of Regents to sign on, but state regulations stood in the way and the idea languished.

From The Park

In 1970, Stephen Hawk BBA 1963 MBA 1964 PhD 1969 brought the vision of his professor and mentor, Frank Graner PhD 1948, to life and created the Applied Securities Analysis Program. Students have since turned $100,000 into $50 million.

But in 1969, it got new life through Baird Brittingham, Tom’s son. The Brittingham Trust gave $100,000 to make Graner’s dream a reality. Money managers and Graner protégés Ted Kellner BBA1969 and Foster Freiss BBA1962 suggested that Hawk, an assistant professor, lead the program. He did just that until 1983, even after becoming a founding partner of Northern Capital Management in 1979. In 1999, the center was named in Hawk’s honor.

While many universities teach virtual investment, UW–Madison’s students have skin in the game. Many have gone on to successful money-management careers.

“Having real money makes all the difference. They are making real decisions,” Hawk said. “The idea is you get the brightest students with a keen interest in investment together and they just feed off each other. It’s amazing what you can learn in that environment.”

51° F

51° F